Economic impacts of COVID-19

Page updated: 14 February 2021

While the NZ economy was in a strong position towards the end of 2019, it took a major hit due to COVID-19.

This said, due to a range of social and economic interventions - including the New Zealand Government's COVID-19 Elimination Strategy, the economy has rebounded much better than expected.

However, there is still a long way to go until the rest of the world recovers from COVID-19 and the flow-on economic impacts. This global context and the ongoing constraints on trade and migration are likely to weigh on the NZ economy for years to come.

While COVID-19 has been unequivocally bad for the economy, there may be some silver linings in a post-COVID world.

The Air Industry is one of the hardest hit

With COVID-19 severely restricting inward migration into New Zealand, and periodically severely constraining domestic air travel as well, it is perhaps not surprising that the air industry has been one of the hardest hit by COVID-19.

Scheduled air traffic dropped 47 per cent in the week following the Government’s announcement of a four-week Covid-19 lockdown, compared to the same time in 2019. According to two weeks worth of flight count data by Airways, traffic dropped 85 per cent in the past seven days compared to the same week in 2019, with 6600 flights reduced to just 982.

Flight count data from Airways New Zealand's Oceanic air traffic control system showing flights in New Zealand's Oceanic airspace in January 2020, left, and April 6, 2020, right. Source: Airways New Zealand

Longer term, the impact of Covid-19 travel restrictions from March saw a dramatic decline in air traffic levels and Airways’ core revenue streams. The Group result is down 233% on the prior year.[1] Perhaps not surprisingly, on 30 September 2020, Airways New Zealand announced a loss of $31.3 million (after tax) for the year ending 30 June 2020.

They also reported on 30-Sep-2020 that current forecasts indicate air traffic levels may only reach 50% of pre-pandemic levels by mid-2021 and the ANSP does not expect to be back to profitability until at least 2023.

In March Airways received a $70 million equity injection as part of the Government’s Aviation Relief Package. Due to the ongoing uncertainty surrounding the recovery of the industry, in August the Government provided Airways with an additional $95 million capital facility, available through to the end of FY22.

In May Airways announced plans to review its services provided from seven regional airports, where air traffic levels were low even prior to Covid-19. A process is now underway whereby independent aeronautical studies will examine and make recommendations on the airspace and operations at each airport. The Civil Aviation Authority will then determine what air traffic management services, if any, are required.

The main impact on the SAR sector of fewer flights is less demand for SAR services. This occurs both because of fewer tourists entering the country and fewer aircraft in the air that could get into trouble or activate a beacon.

---

[1] CAPA (31 Sep 2020) ‘Airways New Zealand Announces $31.3 million loss’, https://centreforaviation.com/members/direct-news/airways-new-zealand-announces-313-million-loss-539075, Accessed 6 Jan 2021.

Tourism was also impacted greatly

In earlier versions of this environmental scan, we noted that over the long term increased tourism was likely to be one of the biggest economic drivers, with direct likely impacts on demand for SAR. With COVID-19 effectively putting a stop to international tourism for the foreseeable future, this conclusion clearly needs to be revised.

Following New Zealand's lockdown, arrivals by foreigners into New Zealand have slowed massively. Now, 71% of all arrivals are for New Zealand citizens.[1]

In the year ended October 2020 (compared with year ended October 2019) provisional estimates were:

- migrant arrivals, at 117,300 (± 1,200), were down 23.5 percent

- migrant departures, at 57,800 (± 500), were down 35.3 percent

- annual net migration gain, at 59,500 (± 1,300), was down from 64,000 (± 200).[2]

For New Zealand, international tourists have been an economic boon until its abrupt halt in 2020. However, tourism has also come with some down-sides, many of which are felt by the SAR sector. Bringing in large numbers of visitors and tourists to New Zealand who engage in outdoor activity with highly variable levels of preparedness inevitably contributes to demand for SAR.

Of course, nobody would say that the costs and externalities associated with tourism are not worth the benefits. However, if there is a silver lining to reduced tourism numbers in the medium term, it is the likely reduction in demand for SAR services due to international tourists getting caught out while recreating outdoors. Of course, the reduction in tourism has contributed to reducing the numbers of New Zealanders creating outdoors and thus a proportion of them needing search or rescue.

---

[1] Ministry of Business, Innovation and Employment (1 May 2020). ‘Tourism Current State,’ https://www.mbie.govt.nz/dmsdocument/11382-tourism-data-factsheet-covid-19-response-4-may-2020, Accessed 6 Jan 2021.

[2] Stats NZ (14 Dec 2020). ‘International migration: October 2020 – Infoshare tables’, https://www.stats.govt.nz/information-releases/international-migration-october-2020-infoshare-tables, Accessed 6 Jan 2021.

COVID-19 impacts on the maritime economy are complex

While tourism has clearly been severely impacted by COVID-19, for the New Zealand maritime economy the news has been much more mixed.

The cruise sector reduced significantly over 2020

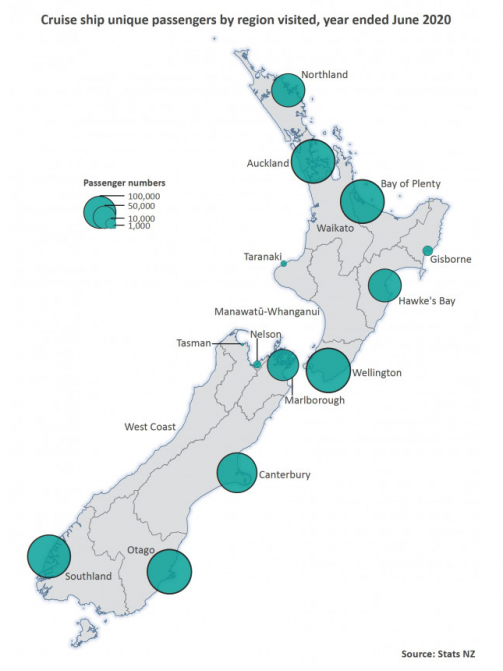

There were 244,000 passenger arrivals and 232,000 passenger departures by cruise ship in the year ended June 2020. This amounted to 283,000 unique passengers over the year, taking into account those who completed part of their journey into or out of New Zealand by air. Unique passenger numbers were down 12 percent (39,000) from the 322,000 recorded in the 2019 season.

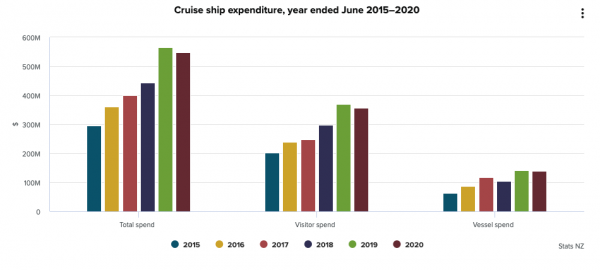

Cruise ship expenditure in New Zealand reached $547.1 million in the year ended June 2020, down 3.2 percent ($18.1 million) following a 27.1 percent increase in the June 2019 year.

Spending by cruise visitors fell to $356.4 million, down 3.5 percent ($13.1 million). This encompasses shore excursions (predominantly pre-booked), including overland tours, and spending ashore by passengers and crew.

Nevertheless, it is important to note that, contrary to popular belief, the cruise ship industry did not cease altogether.

At the time of enforced border restrictions due to COVID-19, the New Zealand Cruise Association recorded 169 ship voyages and 901 port calls, including a continued season increase in the number of overnight port calls. For the corresponding period of the 2019 season, 146 voyages and 823 port calls were recorded. A further 41 voyages and 139 port calls were scheduled for the remainder of the 2020 season to June with an estimated 70,000 cruise ship passengers anticipated.

Statistics NZ, 2020

Based on analysis for 2015–2020, about three-quarters of cruise ship passengers visiting New Zealand are transit passengers. The remaining one-quarter are passengers who enter or leave New Zealand by air, before or after travelling by cruise ship. These passengers complete border clearance, which includes completing arrival cards, and are included in international travel statistics.

Everyone who completes border clearance, regardless of whether they travel by air or by sea, is counted in the arrivals/departures of International travel statistics. Transit passengers who do not complete border clearance are not included in our international travel statistics.

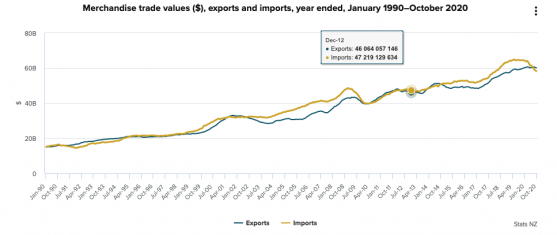

But COVID-19 created a trade surplus for New Zealand

Interestingly, New Zealand was able to maintain its high rate of exports through COVID-19, with lockdowns instead impacting on imports only. This created an annual trade surplus of $2.2 billion, the largest surplus since the July 1992 year.

Imports fell over $1 billion in November 2020, with large falls for cars, fuels, and other commodities, partly offset by a lift in cell phone imports. [1]

In summary:

- Goods exports rose $734 million (1.2 percent) to $60.1 billion.

- Goods imports fell $6.5 billion (10 percent) to $57.9 billion.

Whether a trade surplus is a good thing is a complex thing to determine definitively. However, the fact that NZ was able to continue exporting throughout the COVID-19 impacts during 2020 definitely is a good thing since it brings jobs and much needed revenue into the economy.

The fisheries sector has also been affected, but the recovery outlook is positive too

Revenue in the Fishing and Aquaculture industry is expected to have declined by 11.0% in 2019-20 due to weakened export demand from China. However, the New Zealand Government provided assistance to industry operators during the COVID-19 pandemic. Furthermore, exports of rock lobster and other seafood have already started to recommence, which is likely to boost industry revenue in 2020-21.

The Fishing and Aquaculture industry is forecast to expand over the next five years. Export demand is likely to fully recover over the period from the downturn caused by the COVID-19 pandemic. Asian export markets are anticipated to become an increasingly important source of demand for industry operators over the next five years.[2]

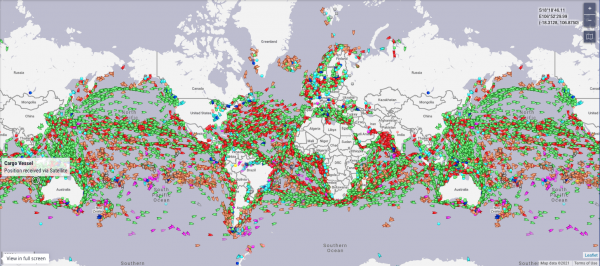

Overall, marine traffic has continued to function

Given levels of media concern about problems at the maritime border, it might be easy to think that COVID-19 brought all marine traffic to a halt. The graph below, updated to 2021, demonstrates clearly that this is not the case.

Map of Global Marine Traffic Flows, 2021 (Marinetraffic.com)

---

[1] Statistics NZ (18 Dec 2020). ‘Imports fall in lead-up to Christmas’, https://www.stats.govt.nz/news/imports-fall-in-lead-up-to-christmas, Accessed 6 Jan 2021.

[2] IBISWorld (15 July 2020). ‘Fishing and Aquaculture in New Zealand’, https://www.ibisworld.com/nz/industry/fishing-aquaculture/696/, Accessed 6 Jan 2021.

Overall, New Zealand has shown surprising economic resilience

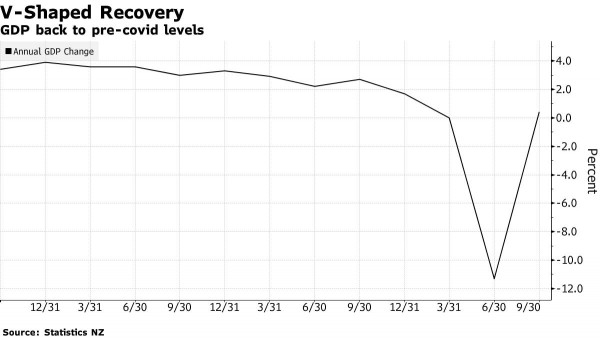

In perhaps one of the few pieces of really good news, the New Zealand economy has effectively revived to pre-coronavirus levels, achieving what commentators are referring to as a “V-shaped recovery”.

This recovery cen be clearly seen in the graph below[1]. Following the significant contraction of GDP in the June quarter, NZ’s GDP surged by 14 per cent in the September quarter 2020.

Linked to these better-than-expected results, as at January 2020, NZ businesses and householder are currently anticipating better days ahead amid positive signs in the economy. Furthermore, the property market continues to be very strong

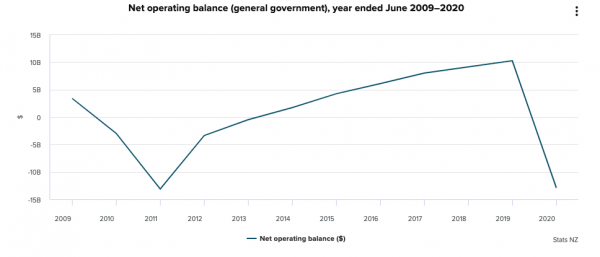

Of course these results came with a cost. In the year ended June 2020, general government net operating balance dropped to a $12.9 billion deficit, as government operating expenses exceeded revenue for the first time since 2013. Operating expenditure growth was driven by a strong increase to subsidies (up $12.6 billion) – particularly, the COVID-19 wage support subsidy – and increased social benefits (up $4.1 billion).

That said, the operating balance is still sitting around that of 2011 as shown in the graph below.

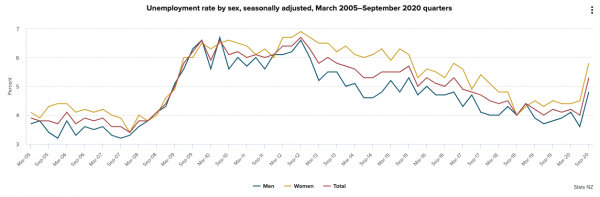

New Zealand's unemployment rate has inevitably increased overall due to COVID-19. However, as you can see in the graph below, the increase has not been unprecedented and only taken us back to levels seen as recently as 2017.

In short, the assumed recession has not actually materialised to date. Of course, we are still in the very early part of what might be considered the ‘medium term’ picture when it comes to COVID-19, but an effective COVID-19 and economic strategy appear to be enabling New Zealand to avoid much of the economic pain experienced by other nations.

In this context, there is some cause for optimism that the funding impacts of COVID-19 in the medium term may not be as bad as expected.

---

[1] Withers, Tracy. (17 Dec 2020). ‘New Zealand Economy Surges Out of Recession in V-Shaped Recovery’ https://www.bloomberg.com/news/articles/2020-12-16/new-zealand-economy-surges-out-of-recession-amid-spending-spree (Accessed 5 Jan 2021).

The global economic picture remains uncertain

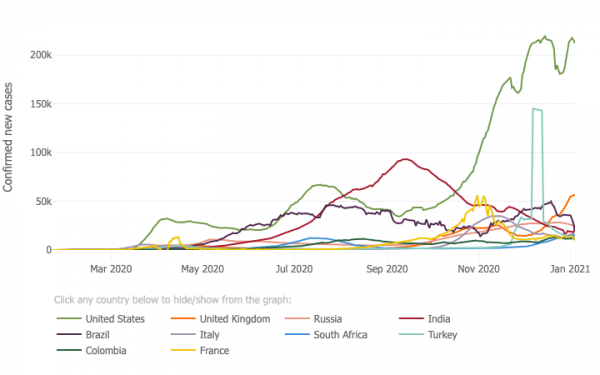

Even as vaccine programmes are being introduced overseas, COVID-19 continues to rampage globally. As at January 2021, there are 86.23 million cases globally, indicating that the pandemic is nowhere near over. More than 1.8 million people have died and the death toll continues to rise.

The graph below shows that, while some countries appear to be getting the virus under control, somve very populated ones such as the USA and UK are still struggling even as at January 2021.

John Hopkins University, https://coronavirus.jhu.edu/data/new-cases, Jan 2021

In addition to the healthcare costs and lost productivity for economies around the world as a result of COVID-19, the costs associated with propping up economies around the world involve trillions of dollars.

Furthermore, the stability of the global financial system still hinges on the vaccines currently being introduced defeating COVID-19 effectively, and as rapidly as possible.

The U.N. secretary-general has projected that the damage COVID-19 has done globally will not be undone by a vaccine alone, and that a full recovery will take years, possibly decades. A U.N. report has also said that as many as 32 million people could be pushed into extreme poverty this year by the pandemic globally.

In this global context, New Zealand's escape from both the economic and social impacts of COVID-19 to date appears nothing short of miraculous.

Yet there may be silver linings for NZ

There is little doubt that the global economy has suffered enormously due to COVID-19 and New Zealand has not completely escaped this pain (though it has avoided much of it compared to other countries. Furthermore, as with any rapidly-evolving environment, there could be economic and innovation opportunities for New Zealand, including in the SAR sector, due to COVID-19.

Countries that can adapt quickly, keeping their people (and visitors) safe from COVID-19 may find significant economic opportunities. For example, because it is (relative to other countries around the world) New Zealand is now considered one of the easiest and safest place to undertake maritime crew transfers, it has become a popular destination for doing so. This facilitates and enables trade through NZ ports, which has multiple benefits for both those who work on ports and those businesses that depend on importing and exporting goods.

Untapped opportunities ahead?

For example, there could be more unmanned maritime vessels in future. This could reduce demand for SAR in future and, if NZ were able to innovate quickly enough, we could become a good destination for both manufacturing and testing such vessels.

In 2017 the UN’s International Maritime Organisation (IMO) began discussions that could allow unmanned ships to operate across oceans. Rolls Royce demonstrated the first remote-controlled, AI-supported unmanned ship earlier this year. In addition, several Japanese shipping firms, for example, are reportedly investing hundreds of millions of dollars in the technology. This raises the prospect of cheaper shipping with fewer accidents in future.[i]

Rolls Royce Prototype Unmanned Ship

Some people think that without experienced crew aboard, accidents that do happen could be much more severe. However, in its 2016 annual overview, the European Maritime Safety Agency found that 62% of the 880 accidents occurring globally (2011-2015) were caused by “human erroneous action”. With COVID-19 inhibiting global marine traffic, it now seems likely that unmanned vessels like the above will be even more attractive to shipping agents.

Following the successful mission above, the world is starting to see more unmanned seafaring vessels in our seas. For example, an unmanned surface marine vessel, called a Saildrone, has become the first to circumnavigate Antarctica in 2018 by sailing 22,000 kilometers (The Maritime Executive 2019). Furthermore, in December 2017, China unveiled what it claims to be the world’s fastest unmanned surface sea vessel with a top speed of over 50 knots or 92.6 km/h (BelTA - People's Daily 2017).

The economy...looking ahead

The COVID-19 pandemic has had a stunning impact on the global economy, and has led to a permanent shift in the operating landscape for millions of businesses. At time of writing, there have been over 100 million cases of COVID-19 have been recorded and over 2 million fatalities globally. In this context, New Zealand has weathered the massive economic storm brought about by COVID-19 surprisingly well.

New Zealand's short-term domestic measures designed to lessen the negative economic and social impacts of COVID-19, including the wage subsidy scheme, appear to have helped New Zealand weather the economic storm of COVID-19 suprisingly well and the outlook ahead is one of relatively rapid recovery compared with most other countries.

The New Zealand economy is expected to achieve real GDP growth of 5.7% in 2021-22, to reach $259.6 billion. New Zealand has outperformed most economically developed nations in its containment of the outbreak of COVID-19, enabling a faster economic recovery. A low cash rate, increasing government consumption expenditure and a falling unemployment rate are expected to boost GDP growth in 2021-22.

Over the next five years, GDP in New Zealand is forecast to grow at an annualised 3.2%, to reach $287.1 billion. While government expenditure is expected to support this growth, the economy is likely to be constrained by slower growth in net migration, construction activity and household expenditure in the years immediately following the COVID-19 pandemic.[1]

The national unemployment rate dropped under 5 percent in the December 2020 quarter and the trend is continuing to prove strong heading into 2021. The rate of unemployment in New Zealand is expected to rise by 2.7 percentage points in 2020-21 to 6.8%. The containment and near-elimination of COVID-19 in New Zealand has enabled most industries to return to normal operations, limiting a rise in unemployment. However, ongoing international travel restrictions have significantly constrained industries reliant on tourism, particularly accommodation, hospitality, sight-seeing transport and retail.

Unemployment is expected to improve in 2021-22, dropping by 0.9 percentage points to 5.9%. A recovery in business confidence is expected to drive an expansion of business demand for labour, creating new employment opportunities. In addition, the gradual reopening of international borders is likely to support a revival in tourism activity, enabling a rebound in employment across tourism industries.[1]

Over the next five years, the national rate of unemployment in New Zealand is expected to decrease at an average annual rate of 0.46 percentage points through 2025-26, to a low of 4.5%. This recovery in unemployment is expected to be driven by strong monetary and fiscal stimulus, as well as the weakness of the New Zealand dollar.[1]

Furthermore, New Zealand has a brand new trade surplus (it is now exporting more than it imports) and this gives it some potential room to import more to invest in projects that may boost medium-term productivity. Such a strategy could help New Zealand extend its short term success in protecing the country and its citizens from COVID-19 into a medium term economic success story.

However, the road to get there is by no means straightforward. Even domestically, GDP remains nearly 4% below crisis levels and there is no near-term prospect for New Zealand's borders to re-open. This weighs on the economy in more ways than just decimating the international tourism industry in New Zealand. It also impacts on the country's ability to source new talent in key skilled industries and even the ability to simply import important materials at comprise key parts of New Zealand-based industrial value chains.

In this context, ANZ has projected that the true economic recovery for New Zealand will take until mid-2022 at the earliest. But really, when it comes to predicting the long term impacts of COVID-19 on New Zealand's economy, and then on the SAR sector specifically, the most honest answer is "we don't know yet".

Either way, demand for SAR services are likely to track broadly in line with the level of outdoor recreation taking place. In some ways, we might consider increased SAR demand an indirect indicator of 'success' since it means the country is free from lockdowns, trading with other nations and hopefully eventually re-opening its borders safely.

---

[1] IbisWorld (5 Nov 2020). ‘The Global Economic Outlook for 2021 – New Zealand’, https://www.ibisworld.com/industry-insider/coronavirus-insights/the-global-economic-outlook-for-2021-new-zealand/